It's happening. The manufacturing sector in the United States is contracting again. The economic growth slowing trend is accelerating. The yield curve is extremely inverted, leading manufacturing surveys are in contraction territory, and the Fed isn't done hiking. It's truly a toxic environment for cyclical companies. Yet, United States Steel (NYSE:X) shares are up more than 10% this year as we're dealing with one of the most unusual recessions in a long time. For the first time in decades, it comes with a strong rotation from growth to value stocks, benefiting companies with pricing power, strong order backlog, and valuations that make sense in a high-inflation environment.

In this article, we're going to take a closer look at one of America's largest and oldest steel producers.

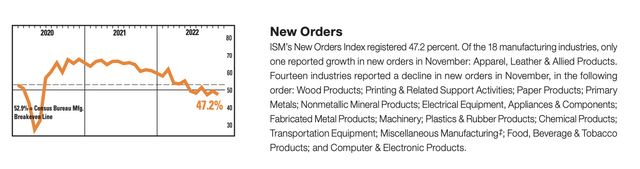

Let's start with the latest piece of news. The US manufacturing sector is now officially in contraction. For the first time since 2020, the ISM manufacturing index has fallen below 50, which is the neutral line between contraction and expansion.

Bloomberg

The good news is that pricing pressure also eased as 87% of survey respondents saw unchanged or lower prices in November. That's up from 80% in October.

Unfortunately, one of the main reasons behind lower prices is lower demand. New manufacturing orders contracted faster as the index fell to 47.2. Just one manufacturing industry reported higher new orders.

ISM

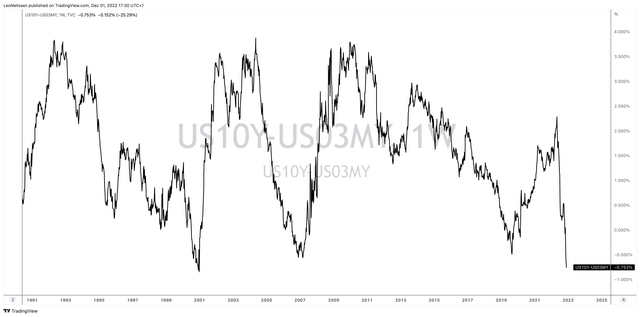

All of these developments make sense as the Fed's favorite recession indicator, the difference between 10Y and the 3M bond yields, is now in negative territory (inverted).

TradingView (10Y/3M Yield Curve)

So far, estimates are that GDP growth will turn negative in the second half of next year. Wells Fargo estimates slow GDP growth in 2023, followed by a contraction in 2024. The way things are going, we'll see a contraction in both years.

Wells Fargo

So, what about steel production? One of the most cyclical things in the world.

These are the most common cyclical industries, according to the Corporate Finance Institute:

Steel is one of them. Not only that, but steel is also directly supplying (1st-tier supplier) two other industries on that list: autos and construction.

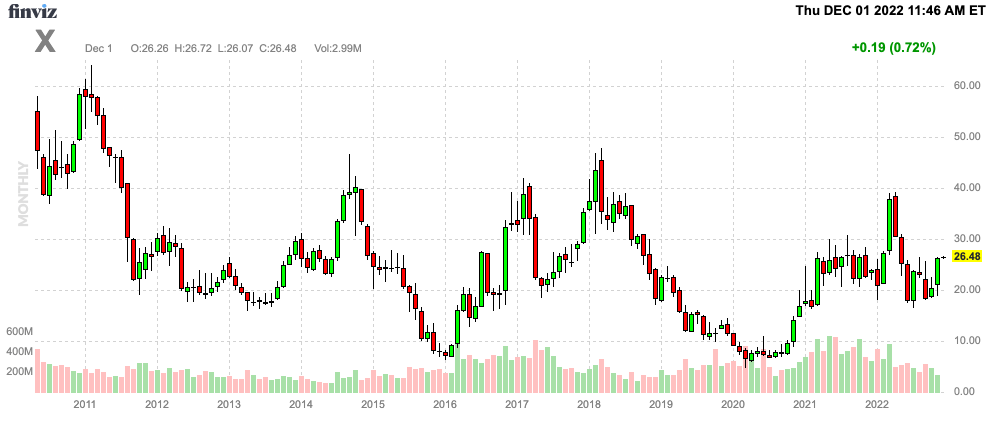

Despite the aforementioned developments, United States Steel is trading at $26. That's roughly 10% higher since the start of this year. It's a terrific performance for a company that used to get smoked during recessions. Since the Great Financial Crisis, X was in three major downtrends that cost it a big part of its equity market value.

FINVIZ

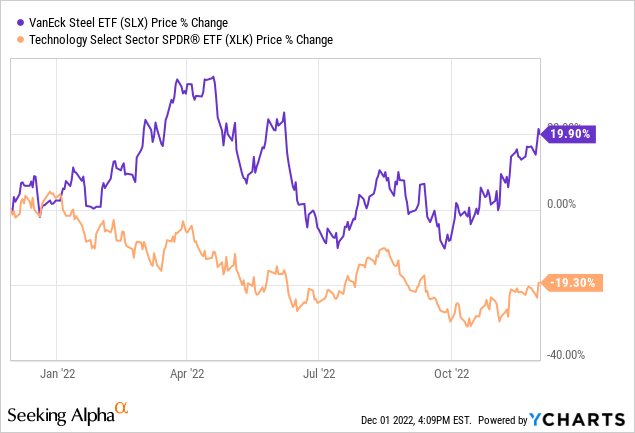

Now, things are different as the entire steel industry benefits from the growth to value rotation.

The most recent piece of news is that United States Steel raised its prices. Correct, raised, not lowered. As reported by Seeking Alpha:

U.S. Steel raised spot prices for hot rolled coil steel in the U.S. by $60/short ton, Argus Media reported Tuesday, following competitor Cleveland-Cliffs' similar move earlier this week.

US Steel is targeting base pricing of $680-$700/st for hot rolled coil, and ~$950/st for cold rolled coil and hot dipped galvanized oil products, according to Argus, or ~$60 above current pricing on HRC and greater gains above current CRC and HDG levels.

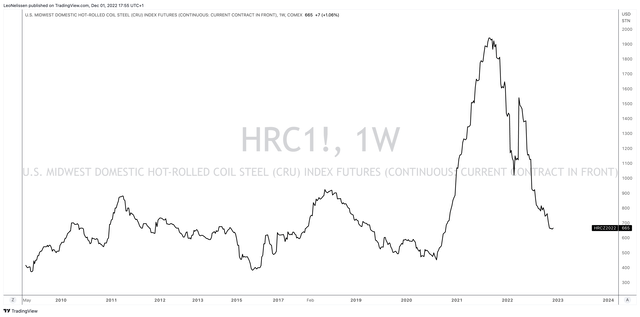

While steel prices have been in a freefall, Midwest hot rolled coil prices are still trading close to $670 per ton. That's above the pre-pandemic median. That's not a bad pricing environment!

TradingView (Midwest Hot Rolled Coil Futures)

Even back in October, the Pittsburgh-based steelmaker noted softening demand, cautious buying, and the impact of the Ukraine war on its European operations.

However, even back then, prices stabilized above historical norms.

Essentially, there are three things that United States Steel has done to improve its business. This includes putting itself into a position of strength. The company has a much healthier balance sheet. The company has $5.8 billion in available liquidity with $1.7 billion of its $2.5 billion in CapEx being spent on strategic investments (instead of just maintenance and related).

Moreover, 80% of total debt is due after 2029 with pension obligations being over-funded.

Second, the company is safely navigating the current headwinds. This means generating higher and more stable through-cycle earnings and free cash flow. In other words, balancing costs and expenses with expected income and pricing power. The recent price hike is a good example of this.

Number three is focusing on the shareholder. The company behind X isn't just a boring steel stock anymore. It's now making money for its owners. The company is on track to lower adjusted net leverage to less than 3.5x (through-cycle) EBITDA. The company is on track to balance cash and expected CapEx while maintaining at least $1.5 billion in cash.

This allows the company to maintain a quarterly $0.05 per share dividend and opportunistic buybacks. The company is currently working on a $500 million buyback program. That's roughly 8% of its current $6.2 billion market cap.

Moreover, the company is bringing 200,000 tons per year in state-of-the-art electrical steel capacity online at its Big River plant.

According to the company:

We will be uniquely positioned with products ranging from 0.25 millimeter to 0.5 millimeter gauge to serve high end electric vehicle grades of steel. Consumers want electric vehicles that are more efficient and effective, and U.S Steel is helping to unlock that potential.

I have to say that I'm impressed with US Steel's improvements. After the completion of Big River 2, including the portfolio of downstream finishing lines to service the automotive and pain markets, the Mini Mill segment is expected to do $1.3 billion in annual through-cycle EBITDA, supported by just $100 million of annual sustaining CapEx.

At the end of this year, the company will (likely) have completed 40% of funding for strategic projects. In other words, the company has used the past two years to acquire new growth, move further down the steel supply chain with better products, and use high prices and income to fund future operations.

That's truly terrifying. And regardless of how bad this cycle may get, the next upswing will be juicy for X shareholders.

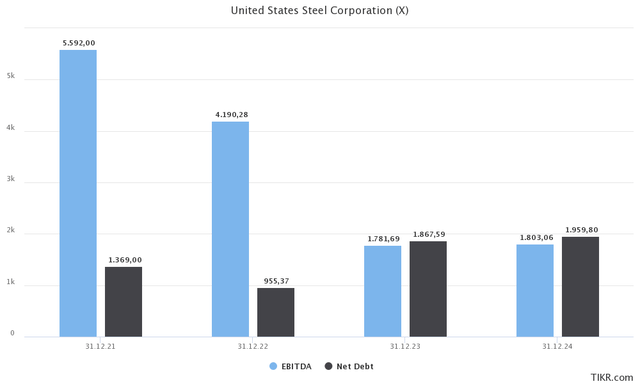

United States Steel is trading at just 4.5x mid-cycle EBITDA. That's based on its $8.1 billion enterprise value, consisting of $1.9 billion in expected net debt and $6.2 billion in stock market equity.

TIKR.com

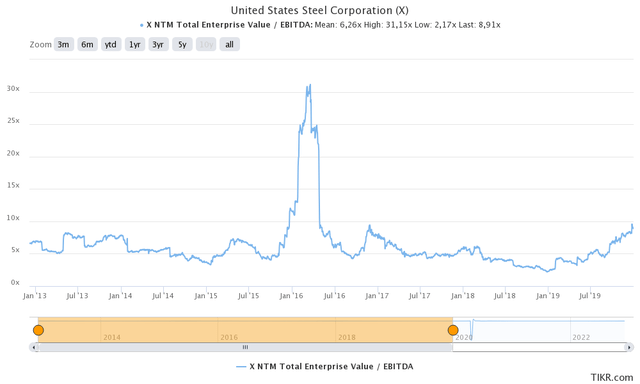

Any valuation below 6.0x NTM EBITDA is very cheap.

TIKR.com

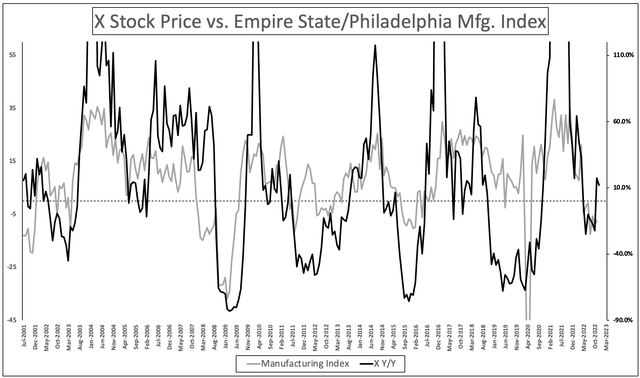

However, I wouldn't make the case that investors need to jump into X for one major reason. We're seeing a significant divergence between economic expectations and the X stock price performance as my chart below shows.

Author

In order to play an expected pivot in 2023 (as I discussed in this article), I would be much more comfortable with an entry closer to $20.

Yet, the risk is not getting that opportunity. It's a risk I'm willing to take.

I haven't covered US Steel in a long time. I mainly cared for the Cleveland-Cliffs (CLF) turnaround and other metal plays.

United States Steel has done a tremendous job turning its business around. The company has added a lot of value-adding products, margins are improving and expected to remain high. Debt has come down to very favorable levels. Liquidity is strong. A big part of strategic projects has been funded. Free cash flow is high and it allows for buybacks.

Moreover, the fundamentals aren't *that* bad. The energy crisis in Europe is benefiting US producers. China is cracking down on pollution (pressuring supply growth), and automotive producers have a lot of backlog volume, providing steel producers with steady orders in uncertain times.

However, given economic developments, I'm looking for a lower entry. The X valuation is already favorable, but a move lower to $20 would make X a great risk/reward trade for my portfolio and personal risk profile.

Courtesy : seekingalpha.com